Why “High-Quality Content” Fails and How Content Intelligence Reveals What Really Works

November 20, 2025

You followed every best practice. You optimized headlines, tightened structure, matched search intent, and produced content that looked polished and professional. You did the work the industry says should drive results.

But engagement is inconsistent. Content performance stalls. And the metrics you’re told to celebrate — clicks, impressions, downloads — rarely translate into meaningful movement.

And here’s the part many marketers rarely say out loud: you can do everything “right” with your content and still watch the numbers refuse to budge.

Worse, dashboards show progress while pipeline stays flat. Content appears to work on paper, but buyers don’t move. And increasingly, AI assistants surface competitor answers because your content lacks the signals LLMs need to understand or trust it.

You are not imagining it. You’re not alone, either.

According to the Content Marketing Institute, only 29% of B2B marketers describe their content strategy as highly effective, while 58% say it’s only moderately effective.

And according to our report, 81% of marketing leaders say half or less of their content drives meaningful outcomes, even as production continues to rise.

More content. More tools. More planning.

Same unpredictable outcomes.

Not because the content is poorly made. But because it isn’t aligned to what buyers actually need — or how they make decisions.

And when that misalignment persists, leaders stop viewing content as a strategic engine and start seeing it as a cost center.

That sinking feeling when a beautiful guide delivers zero movement in pipeline is not a creative problem. It’s a signal problem.

This is one of the symptoms of the Marketing Data Mirage: content that appears successful because the metrics look good, but ultimately fails to influence real buyer action.

The industry’s definition of “quality” prioritizes polish over proof. Teams follow the right creative steps but rely on signals that don’t reflect buyer reality.

Here’s the shift most teams haven’t caught up to: AI isn’t amplifying your content — it’s auditing it. And anything that doesn’t align with real buyer signals gets quietly ignored.

Most teams are still operating on outdated assumptions:

- Persona-based content planning predicts what buyers need.

- SEO best practices still govern visibility.

- Repurposing solves content fatigue.

- Clicks and downloads signal movement.

Which is why performance doesn’t improve until content decisions are guided by something else entirely — Content Intelligence.

The Discovery Disruption

Here’s the harder truth: the performance gap isn’t just a content problem; it’s a discovery problem.

AI assistants, evolving search algorithms, and personalized feeds now determine what gets surfaced, to whom, and for how long. Visibility is no longer something marketers “earn” once with keywords or backlinks. It’s reassessed continuously based on dynamic relevance.

This is why AI Visibility matters because in AI-driven ecosystems, discoverability is determined by how clearly your content aligns with real buyer signals, not how much you publish.

And in AI-driven answer engines, content isn’t “ranked” — it’s interpreted. If your content lacks clear behavioral and semantic signals, LLMs simply won’t surface it.

Discovery has shifted from static ranking to real-time recommendation.

This means:

- Rigid SEO checklists need to evolve into strategic guides

- Topic choices matter more

- Clear buyer insights matter the most

- AI Visibility now plays a defining role in who sees your content at all

Visibility isn’t guaranteed by volume. It’s granted by relevance in the moment.

You’ve likely seen it yourself. A strong piece gets ghosted by the algorithm because it didn’t match the contextual signals of the moment.

And if content decisions are guided by outdated discovery assumptions, even your strongest, best-crafted assets can disappear into the noise.

Visibility isn’t failing because content is weak. Visibility fails when relevance fails.

To make sense of the new discovery landscape:

- SEO is about optimizing for traditional keyword-based search results. It focuses on matching terms and satisfying ranking signals used by search engines.

- AIO is about optimizing content for how AI assistants and LLMs interpret, trust, select, and cite information. It covers all AI-driven discovery systems, not just search.

- GEO is a subset of AIO that focuses specifically on generative search engines (Google SGE, Bing Copilot Search, Perplexity) and how they assemble multi-source answers.

- Content Intelligence focuses on verified buyer behavior patterns and reveals what topics, structures, and formats buyers actually validate across channels. It informs both AIO and GEO.

This is where the content performance problem actually begins: not with quality, but with resonance — something traditional metrics can’t reveal, and something Content Intelligence is built to uncover.

The Content Resonance Gap

The gap most marketers never see is the one that matters most.

Teams often rely on clicks, comments, and downloads and assume content is working. But clicks don’t signal intent. Downloads don’t signal readiness. Views don’t signal movement.

The content resonance gap is the space between what brands publish and what buyers actually explore, value, or act on.

Most content is planned around assumptions about what buyers care about rather than verified insight into their real questions, comparisons, and decision paths.

And in the AI era, content that fails to demonstrate clear relevance won’t appear in LLM-generated summaries, even if it ranks traditionally. LLMs don’t reward clever writing. They reward clarity, structure, and signal strength.

Before exploring the frictions this creates, it helps to recognize how the resonance gap shows up in everyday performance patterns:

- High engagement but low pipeline contribution

- Impressions without meaningful attention

- Assets buyers skim but don’t absorb

- Messages built for personas instead of real-time queries

The result is predictable: more content, more noise, less impact. Not because the content isn’t good — but because it isn’t aligned.

Closing this gap requires more than strong writing or thoughtful strategy. It requires the intelligence to see what truly resonates, so content decisions reflect verified buyer signals instead of assumptions.

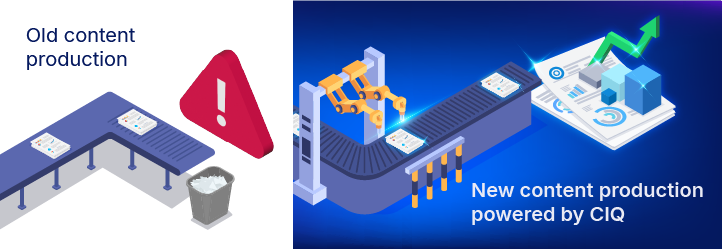

The Shift: From Creation to Intelligence

Content Intelligence connects discovery, engagement, and behavioral signals into a single source of truth about what buyers actually respond to. It replaces intuition-driven planning with evidence-driven clarity.

For most teams, content planning still depends on guesswork — assumed topics, generic best practices, and outdated SEO checklists. Content Intelligence replaces that uncertainty with evidence.

Content Intelligence shows:

- what buyers search for

- what content formats they spend time with

- what routes they take on your site

- what actions they repeatedly avoid

- what themes correlate with opportunity creation

This is the shift: Performance is no longer about producing more. It’s about creating content anchored on verified buyer signals.

When content creation begins with real insight, everything becomes more predictable — what to make, how to position it, and where it will matter.

And nowhere is this shift clearer than in the frictions every marketer feels but rarely identifies.

The answer isn’t more optimization. It’s a clearer understanding of what real buyers consistently validate across formats, channels, and stages. That’s the discipline Content Intelligence introduces.

The Four Content Frictions

These frictions aren’t random — they’re symptoms of the Marketing Data Mirage. They appear when dashboards say content is working, but buyers (and machines) say otherwise.

These frictions manifest when content is created without verified buyer signals guiding what it should say, solve, or surface. They’re the hidden forces behind why “high-quality” content fails — and why marketers feel like effort no longer translates into results.

This is the core of the performance gap. Address these friction points and content begins to compound. Overlook them, and even the strongest assets fall flat.

Friction 1: Resonance — The Connection Problem

Most content planning starts with personas. But buyers behave based on urgency, context, and the questions they’re trying to answer in the moment.

Personas assume stable motivations, but real buyers operate on urgency and context. AI discovery systems don’t care about persona documents — they respond to demonstrated behavior. Content Intelligence surfaces what buyers actually validate, not what personas predict.

Resonance breaks when:

- content matches the persona, but not the moment

- messages reflect brand priorities, not buyer questions

- topics are chosen for search volume, not decision-making value

A scenario many marketers recognize: A blog written for C-suite members of the buying committee gets solid SEO traffic — but real evaluators spend their time on comparison pages, because that’s where decisions actually take shape.

You’ve seen this before; something performs beautifully in analytics but barely makes a dent in actual conversations.

Resonance is not a creative issue; it’s a signal issue. Without real buyer behavior guiding topic selection, content can be exceptionally written and still irrelevant.

Content Intelligence reveals what buyers consistently return to, explore deeply, or compare — the signals that define true resonance.

Friction 2: Distribution — The Saturation Problem

In a world governed by AI recommendations, distribution isn’t about being everywhere. It’s about appearing where behavior proves buyers actually engage.

Distribution breaks when:

- content is spread thin across channels

- algorithms suppress low-performing assets

- buyers encounter content out of sequence

- visibility is optimized for reach, not relevance

A familiar scenario: A campaign gets healthy impressions on LinkedIn but zero progression on website paths, meaning visibility didn’t translate into meaningful engagement.

It looks like reach. It feels like progress. But movement? Still missing.

This creates the illusion of “being everywhere,” while engagement stays shallow.

Content Intelligence reveals which channels sustain attention, which formats succeed at each stage, and where visibility actually influences action.

Friction 3: Relevance — The Value Problem

Marketers create content they believe is valuable. But buyers define value differently — not by polish, but by how well it moves a decision forward.

Relevance breaks when:

- content answers questions no one is actively asking

- topics reflect internal messaging, not external demand

- assets explain, but don’t differentiate

- content informs, but doesn’t accelerate decisions

A scenario marketers know well: A well-crafted guide earns internal praise, but buyers spend more time on a shorter, more direct comparison asset because it better supports evaluation. And as AI assistants increasingly decide which content gets surfaced, “value” is determined by clarity, structure, and alignment — not length, design, or clever writing.

Value is defined by buyer validation — not internal approval.

Content Intelligence shows what buyers repeatedly seek, compare, or evaluate, grounding relevance in proof rather than assumption.

Friction 4: Fatigue — The Volume Problem

Everyone is publishing more content. But more content often produces more sameness — not more clarity.

Fatigue sets in when:

- brands repeat the same messages

- audiences see identical templates across vendors

- teams chase trends instead of insight

- content overwhelms instead of guides

A common pattern: A company delivers 15 new assets in a quarter, yet buyers spend 80% of their time on the top three — the ones aligned to real buying behavior.

That sinking feeling of “we’re doing more but getting less”? This is where it comes from.

The issue isn’t effort. It’s that the discovery systems deciding what buyers see operate on rules most teams still aren’t measuring.

This is why output increases while impact shrinks.

Content Intelligence reveals where demand actually exists, so teams produce fewer, higher-impact assets that cut through instead of blend in.

The Payoff: Confidence in What Works

When content decisions are driven by verified buyer signals instead of assumptions, everything changes.

Quality stops being defined by polish and starts being defined by proof. Visibility becomes predictable, not accidental. Distribution becomes focused, not scattered. Relevance becomes measurable, not subjective. And content finally behaves like the strategic asset it’s meant to be.

That’s the value of Content Intelligence. It gives marketers the clarity to know what buyers actually need, the confidence to create with purpose, and the insight to prioritize what will drive real movement — not just activity.

The result isn’t more content. It’s content that performs. Content that compounds. Content you can stand behind.

Content that works because it’s aligned to what buyers do next — not what brands hope they’ll do.

And this is exactly what DemandScience helps marketers achieve.